At Varntige we love supporting charities and not-for-profit entities – whether that be through sponsorship and our community days or assisting organisations with managing their administration and bookkeeping needs. Anything to help keep these wonderful organisations running.

As part of this it is important to keep up to date with the ever changing reporting and legislative requirements for registered charities.

Reporting

Charities have annual reporting requirements to be made to charities services which is made up of 2 parts the annual return form and the performance report. These need to be filed within 6 months of your charities end of financial year. The Annual Return covers information about your people and your operations while the Performance Report covers information about your charity and its activities. Reporting is important to ensure charities are transparent about the funds they receive and how these are utilised. It also provides a valuable resource to show the public and funders all the incredible work you are doing in your community.

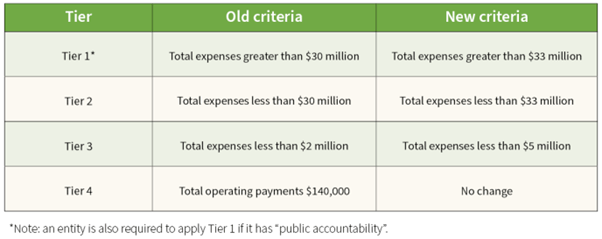

The reporting standards are set by the XRB (External Reporting Board), and the requirements vary based on the size of the charity. These requirements are split into four tiers with Tier 1 for the biggest charities having the most stringent requirements while those tiny charities fall under Tier 4.

The XRB released updated criteria back in March 2024 as per the table below which means more charities will fall into the lower tiers of reporting. These new criteria will be applicable from April 2025; however, they can be adopted for any charities wishing to use them with an end of financial year after 28th March 2024.

The biggest change introduced for Tier 4 is the combined Annal Return & Performance Report meaning that those smallest charities (with total operating payments less than $140,000) only have one report to file at the end of financial year.

For Tier 3 there are some changes to the Statement of Service performance which includes non-financial information for the business. This is where you get to brag about all the good your charity has done in the last financial year. For Example, how many food packages were delivered, or plants donated/planted in a year, how many clients benefited from your services. Shout all that good work from the roof tops.

Annual Return

There have also been some changes to the annual return form including new self-identification questions around whether you consider your charity to be a Kaupapa Māori, Pasifika, or support Ethnic Communities in NZ or overseas.

You will also need to be able to report on accumulated funds (Tier 1-3). So surplus funds on your balance sheet. The requirement is just to make note of anything funds have been held back for. E.g. future projects, a new building purchase.

Audit or Review

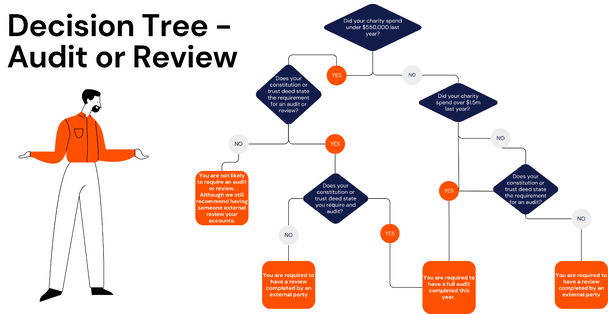

Does your charity need to undertake an audit or review each year. There are a couple of things to consider here. The first is the statutory requirements (those set out in law) which state thresholds for audit or review requirements. The next is your own charities constitution or trust deeds requirements. The final thought on this is the transparency of having an external party look over your data regularly to help identify any potential issues.

Take a look at our quick decision tree which can help you work out what your requirements may be:

If you need help understanding your charities obligations please feel free to reach out and we can help get you on track.

Check out Part Two of the updates here.